Home Credit CZ

Description of Home Credit CZ

In the Home Credit mobile application, you have your finances under control anytime and anywhere. In it you will find everything about your loan, consolidation and purchase in installments. You have repayment, account movements and other withdrawals under your thumb. A virtual card is waiting for you there for secure payment.

You simply log in to the application with a code, fingerprint or face recognition. You can choose light or dark mode, which is gentle on your eyes.

Try the app today and let us know how you like it.

Easy repayment and repayment details

Immediately after logging in, you can see the current status and the repayment date. You can send the installment in a few clicks via your bank's icon or by using a QR code. We will fill in the account number, amount and variable symbol for you.

Monthly statements in digital form

We save our nature. In the application, you will find statements for the last 12 months in one place.

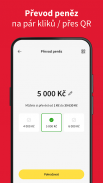

Instant money transfer

Just a few clicks in the app and the money goes to your bank account. You can also pay via QR code. When you need more, you can apply for a credit limit increase.

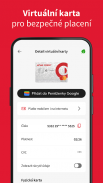

Virtual card for secure payment

We will issue the card to you right away directly in the application. Before you go to the store or ATM, add your virtual card to Google or Apple Wallet. In the application, you can securely view your card details and confirm online purchases. If necessary, you will solve the blocking or change the limits.

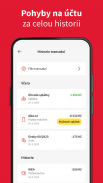

Account movements for the entire history

You can clearly see all your purchases, transfers and repayments in the transaction history.

An example of a loan that can be offered in a mobile application

Illustrative calculation according to law for a revolving loan: Loan amount CZK 80,000, annual interest rate 15.9%, APR 17.1%, you will pay a total of CZK 86,890. Individual consecutive monthly installments: CZK 7,727, CZK 7,638, CZK 7,550, CZK 7,462, CZK 7,373, CZK 7,285, CZK 7,197, CZK 7,108, CZK 7,020, CZK 6,932, CZK 6,843 and CZK 6,755. The installments and the amount you pay in total are mathematically rounded. The stated values apply on the assumption that the entire amount of the loan is drawn immediately, without cash, in full, at the above-mentioned interest rate and without a fee, when a revolving loan is granted for a period of one year and repaid in 12 monthly installments with the same principal amount. The offer does not take into account further borrowing or the use of additional services.

The offer does not create a claim to the provision of a loan. We assess each loan application individually, it may differ from the one presented, and the maximum APR will not exceed 31.8%.

A flexible loan is a revolving loan. This means that the loan agreement is concluded for an indefinite period of time and the client can draw the loan repeatedly up to the amount of the unused credit limit. If the client repays the amount owed, he can use the credit line again in its entirety

A flexible loan is a revolving loan. This means that the loan agreement is concluded for an indefinite period of time and the client can draw the loan repeatedly up to the amount of the unused credit limit. If the client repays the amount owed, he can use the credit line again in its entirety.